State Farm is a well-known insurance company that has been providing auto, home, and life insurance to customers in the USA for over 98 years. With its headquarters located in Bloomington, Illinois, State Farm has over 58,000 employees and more than 19,000 agents spread across the country.

A Review Of State Farm

Products and Services: State Farm offers a wide range of insurance products and services, including:

- Auto insurance: State Farm’s auto insurance policies cover liability, collision, and comprehensive damages, and also offer coverage for uninsured/underinsured motorists.

- Homeowners insurance: State Farm’s homeowners insurance policies cover damages to your home and personal property, and also offer liability coverage.

- Renters insurance: State Farm’s renter’s insurance policies provide coverage for personal property and liability.

- Life insurance: State Farm offers term life insurance, whole life insurance, and universal life insurance policies to help protect your loved ones.

- Business insurance: State Farm also offers business insurance coverage for small business owners.

Customer Service

State Farm is known for its exceptional customer service, with a 24/7 customer support team available to answer questions and assist with claims. The company also offers a user-friendly website and mobile app that allows customers to manage their policies and file claims online.

Pricing

State Farm’s insurance rates can vary depending on several factors, including your location, age, driving record, and the type of coverage you need. However, the company is known for offering competitive rates and discounts for safe driving and bundling multiple policies.

Pros:

- Wide range of insurance products and services

- Excellent customer service and 24/7 support

- Competitive rates and discounts

- User-friendly website and mobile app

Cons:

- Limited availability in some states

- Claims process can be slow in some cases

State Farm Car Insurance Reviews

Each year, our research team researches dozens of insurance companies in order to generate rankings of the best providers. For State Farm, we collected over 70 pieces of data — including its total written premiums, complaint ratio, state availability, types of coverage offered, J.D. Power ratings, and more. We also analyzed the average costs for a variety of driver profiles and locations and surveyed past customers on their experience.

We give State Farm car insurance a rating of 9.3 out of 10.0 and awarded it Editor’s Choice in 2022. The company’s rating was aggregated from five of our key performance areas of reputation, availability, coverage, cost, and customer experience.

| Overall Rating | 9.3 |

|---|---|

| Reputation | 9.6 |

| Availability | 9.7 |

| Coverage | 8.9 |

| Cost | 9.2 |

| Customer experience | 9.4 |

*Ratings are determined by our editorial review team. Learn more about our scoring methodology below.

Is State Farm Auto Insurance Good?

Founded: 1922

Better Business Bureau (BBB) rating: A+

AM Best financial strength rating: A++

State Farm has been around for almost a century, and today it’s one of the most popular car and home insurance providers in the country. The company offers several unique options and features that drivers can take advantage of, including:

- Strong industry and customer service reputation: State Farm has a stellar customer service reputation and strong industry ratings in J.D. Power studies.

- Low rates for young drivers: Our research shows that young drivers on average can find affordable car insurance coverage through State Farm. The company also offers discounts and a telematics insurance program geared towards bringing down costs for those who lack driving experience.

- Variety of coverage options: With State Farm, drivers can purchase standard car insurance coverage as well as roadside assistance, rental car reimbursement, travel expense and rideshare insurance.

State Farm Insurance Company Reviews

The largest auto insurer in the U.S., State Farm has been in business since 1922. According to the National Association of Insurance Commissioners (NAIC), State Farm wrote $46.6 billion in private passenger auto insurance premiums in 2022, with a total of 16.8% of the market share. That’s about $8 billion more than the second-largest provider, Progressive.

Many people prefer working with local insurance agents, and State Farm has over 19,000 agents spread across the U.S. in every state except Massachusetts and Rhode Island. That means there’s a good chance you can find a State Farm agent in your area.

State Farm Customer Reviews

State Farm has a great customer service reputation, backed by many positive customer reviews and industry studies. Many positive customer reviews mention the company’s affordable coverage for drivers and several discount opportunities and usage-based programs that are available.

State Farm Car Insurance Customer Service

In August 2022, we conducted a nationwide car insurance satisfaction survey that polled 6,923 people. Of those who participated, 19% reported that they had a State Farm car insurance policy, making it the most popular provider in our survey.

Here’s an in-depth look at how customers rate State Farm out of 5.0 compared with the overall average from our survey:

| State Farm Average |

Insurance Company Industry Average |

|

|---|---|---|

| Overall customer satisfaction | 4.2 | 4.2 |

| Affordability | 3.8 | 3.7 |

| Discounts and savings programs | 3.8 | 3.7 |

| Selection of coverage and add-ons | 3.9 | 3.9 |

| Car insurance shopping process | 4.0 | 3.9 |

| Company website | 3.9 | 3.9 |

State Farm Auto Claims

Our survey found that nearly 42% of all respondents with a State Farm policy have filed a claim, while 58% have not. Most policyholders who participated were happy with State Farm’s customer service during the claims process, giving the company a 4.2-star rating out of 5.0. Additionally, respondents gave the company a 4.2-star rating for satisfaction with the claim outcome or settlement.

State Farm Auto Insurance: J.D. Power Ratings

State Farm earned 885 out of a possible 1,000 points in the J.D. Power 2022 U.S. Insurance Shopping StudySM, which polled customers to determine satisfaction with each stage of the shopping experience. That put the provider in first place for the large insurers category and the only company ahead of the segment average.

State Farm received a higher rating in the J.D. Power 2021 U.S. Auto Claims Satisfaction StudySM, with 892 out of a possible 1,000 points (the average was 880). The study considered responses from 7,345 auto insurance customers who had settled claims in the past six months.

State Farm Auto Insurance: Reddit Reviews

Reddit isn’t known as a primary source for insurance reviews, but you’ll find plenty of auto coverage discussion on the news aggregator site. State Farm customers on the platform often note the company’s affordable rates. The ready availability of local agents is also a common point of praise from State Farm customers on Reddit.

State Farm: BBB Rating

State Farm holds an A+ rating from the BBB, and State Farm Insurance reviews from customers on the BBB give the company a nearly 1.2 out of 5.0-star average rating. The insurer has only had 867 complaints filed in the past 12 months, which is a low number for a company of this size.

Our team reached out to State Farm for a comment on these scores but did not receive a response.

State Farm Insurance Complaints

According to the NAIC, State Farm accounted for just under 11% of total car insurance complaints in 2022. Since the company has about 16% of the market share, it has fewer complaints than average for its size. In other words, most customers have a positive or neutral experience with the company’s service.

State Farm Insurance App Reviews

State Farm makes it easy to manage your policy with its highly rated mobile app. The app has a customer review score of 4.7 out of 5.0 stars on Google Play based on over 140,000 State Farm insurance reviews and 4.8 out of 5.0 stars in the App Store based on more than 650,000 ratings. With the State Farm app, you can pay your bill, view ID cards, file a claim, request roadside assistance and more.

State Farm Auto Insurance Coverage

State Farm offers the following standard types of coverage:

- Liability car insurance

- Collision insurance

- Comprehensive insurance

- Medical payments coverage (MedPay)

- Personal injury protection (PIP)

- Uninsured/underinsured motorist coverage

State Farm Coverage Options

State Farm also offers a few policy add-ons:

- Roadside assistance: Towing to the nearest repair shop, fuel delivery, spare tire changes, lockout service, battery jump-starts and up to one hour of mechanical labor at the breakdown site are all covered with this option.

- Rental car reimbursement: This option covers rental vehicle costs for qualifying events up to a limit in your policy. You can choose to have State Farm reimburse you for the cost or schedule and pay for a rental.

- Travel expense: If you’re 50 miles or more away from home and need your car repaired, this option covers up to $500 for food and lodging. It only applies if your damages are covered by a collision or comprehensive insurance policy.

- Rideshare insurance: If you drive for a company like Uber or Lyft, this option ensures you have coverage at all times.

Drive Safe & Save Program™

Like a number of leading providers, State Farm offers a usage-based insurance option in addition to standard insurance. Drive Safe & Save gives State Farm policyholders a discount for signing up. Then, upon policy renewal, drivers can save up to 30% if they’ve practiced safe driving habits. Our 2022 car insurance survey that polled 1,000 respondents found that 65% of people never take advantage of usage-based programs.

When you first sign up for the program, you’ll receive a small Bluetooth beacon to mount inside your car. This beacon communicates with the Drive Safe & Save app on your phone, which then assigns you a driving score and relays the information to State Farm. Here’s what it tracks:

- Acceleration

- Braking

- Cornering

- Speed

- Time of day

- Phone use

Accelerating or braking quickly, taking corners too fast, speeding, taking late-night trips and using your phone while driving will decrease your score. The good news is that if you use the Drive Safe & Save app and get a poor score, State Farm won’t raise your rates. You might see that initial discount disappear on your auto policy renewal, though. Also, if you had been receiving a low-mileage discount, you could lose that discount if the app determines you are not a low-mileage driver.

Lastly, be aware that the Drive Safe & Save app uses cellular data to send trip information to State Farm while you’re driving. This could affect your phone bill depending on your plan and how much you drive.

How Do State Farm Insurance Claims Work?

You can file a claim with State Farm by phone, on the website or through the company’s mobile app. With the State Farm app, customers can upload photos and documents, check the status of a claim and communicate with claims representatives. The app also includes a virtual estimate tool that helps customers take clear photos of vehicle damage. This can accelerate the process of getting an initial estimate and even payouts for covered damage.

How Much Does State Farm Auto Insurance Cost?

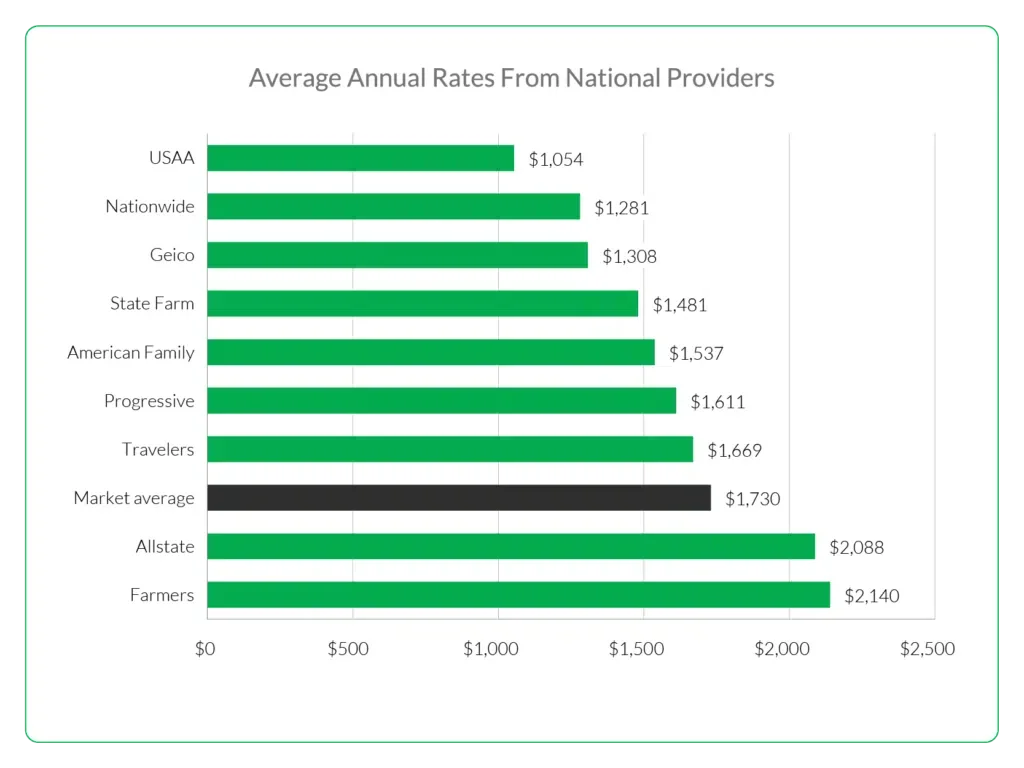

Our rate estimates show 35-year-old drivers with good credit and driving records pay about $1,481 per year or $123 per month for full coverage insurance from State Farm. Averaging about 15% cheaper than the national average of $1,730, this estimate lands State Farm among the cheapest car insurance providers in the country.

State Farm Price Quote

State Farm is one of the cheapest options for drivers with a recent accident or a driving under the influence (DUI) conviction on their records, according to our estimates. However, State Farm can be an expensive option for drivers who have poor credit. This doesn’t apply to drivers in California, Hawaii, Massachusetts or Michigan since these states don’t allow credit-based insurance pricing.

State Farm Car Insurance Rates by Age

Age is one factor that will impact the price you pay for State Farm auto insurance. Younger drivers with no experience can expect to pay thousands of dollars more on average than experienced drivers. Here’s a look at average monthly and annual cost estimates for State Farm broken down by age.

| Age | State Farm Average Monthly Cost Estimate | State Farm Average Annual Cost Estimate | National Average Cost Estimate |

|---|---|---|---|

| 16 | $346 | $4,146 | $6,912 |

| 17 | $310 | $3,714 | $5,612 |

| 18 | $279 | $3,340 | $4,958 |

| 21 | $194 | $2,322 | $2,786 |

State Farm Car Insurance Rates by Driver Profile

Besides age, there are other factors that will influence what you pay for car insurance, including your driving record, location and vehicle. Here are a few more State Farm cost estimates that apply to different types of 35-year-old drivers, including those with poor credit and problematic driving records.

| Driver Profile | State Farm Average Monthly Cost Estimate |

State Farm Average Annual Cost Estimate |

National Average Annual Cost Estimate |

|---|---|---|---|

| Good credit and driving history | $125 | $1,497 | $1,976 |

| Poor credit | $308 | $3,696 | $3,196 |

| One recent accident | $146 | $1,749 | $2,794 |

| DUI conviction | $182 | $2,180 | $4,018 |

Is State Farm Expensive?

According to our rate estimates, State Farm is among the more affordable providers out there. We found full coverage rates from State Farm to be about $1,481 per year, which makes it cheaper than providers like Progressive and Allstate on average.

Here’s how it compares to popular national car insurance companies:

Compare State Farm Auto Quotes

The table below shows how State Farm compares to other regional and national providers in terms of average monthly and annual costs. The rate estimates are based on full coverage insurance for a 35-year-old married driver with a good credit score and clean driving history.

| Car Insurance Company | Average Monthly Cost Estimate |

Average Annual Cost Estimate |

|---|---|---|

| USAA | $97 | $1,168 |

| Nationwide | $108 | $1,297 |

| Erie Insurance | $111 | $1,337 |

When Is State Farm Expensive?

Although State Farm is typically affordable for most drivers, there are some instances when drivers will pay more than others. Car insurance rates from State Farm, as with any other provider, are calculated based on the likelihood of you filing a claim — and costing an insurer money. Understanding the factors that are in your control can help ensure you get the lowest car insurance rate possible.

These include:

- Recent at-fault accidents

- Traffic violations on your record

- Credit score

- Type and age of vehicle

- ZIP code

- Age

- Marital status

You have a bit of control over your final rate, though. You can select a higher deductible amount to lower your overall cost, and you can choose the types and limits of coverage on your policy.

State Farm Car Insurance Discounts

After a thorough cost analysis, we’ve determined that State Farm has some of the lowest car insurance rates for students and teens. The auto insurance provider offers one of the most generous student discounts in the industry — up to 25% — and the discount can last until the driver turns 25, even if they’ve already graduated college. Drivers under 25 can also participate in the Steer Clear® program, which uses an educational app to reward safe drivers with a discount of up to 20%.

Here’s a full list of State Farm car insurance discounts:

| State Farm Discount | Discount Description |

|---|---|

| Multi-policy discount | Save money by bundling your car insurance with other State Farm insurance products, such as life, renters, condo or homeowners insurance. |

| Multi-car discount | Get a discount by insuring two or more cars in your household under the same policy with State Farm. |

| Accident-free discount | Lower your premium by staying accident-free for three continuous years while being insured by State Farm. |

| Good driving discount | Receive a discount by going three years or more without moving violations or at-fault accidents. |

The number of available State Farm discounts is comparable to what you will find with other top insurers.

State Farm Home Insurance

Our research shows that State Farm home insurance generally costs less than the national average, depending on where you live. According to a report released by the NAIC, the average homeowner paid around $1,249 per year in home insurance costs in 2018. State Farm ranks among our top picks for the best homeowners insurance options, earning the distinction of being Our Pick for New Homeowners.

State Farm Homeowners Insurance Quotes

We reached out to State Farm for home insurance quotes to give you a better idea of how much coverage may cost in your area. The estimates below are for single-family homes.

| Location | Home Square Footage | Monthly Cost | Total Cost Per Year |

|---|---|---|---|

| Mckinleyville, Calif. | 1,344 square feet | $63 | $756 |

| Charlotte, N.C. | 1,595 square feet | $111 | $1,330 |

| Mechanicsburg, Pa. | 2,144 square feet | $107 | $1,280 |

| Schertz, Texas | 2,346 square feet | $182 | $2,181 |

| Richmond, Va. | 2,112 square feet | $95 | $1,137 |

State Farm Home Insurance Discounts

State Farm offers the following home insurance discounts:

- Multi-line discount: When you bundle your insurance policies with State Farm, you may be eligible for additional auto and home insurance discounts.

- Home security insurance discount: You may qualify for a home insurance discount if you installed a fire, smoke or burglar alarm, or any other type of monitoring system in your home.

- Roofing discount: If you have or install a roof with impact-resistant roofing products, such as hail-resistant shingles or Class 4 shingles, you may be eligible for a discount on your home insurance premium.

What Factors Affect Home Insurance Costs?

Home insurance premiums are based on factors such as your location, claims history and property details. Here are a few key factors to consider before buying a home insurance policy:

- Location: The state and ZIP code where you live can drastically affect your premiums. States near coastal areas, such as Louisiana, Florida and Texas, often have the highest home insurance rates. Insurance premiums for homes located in inland states tend to be lower.

- Claims history: If you’ve filed a claim within the past three to five years, you can expect to see higher home insurance rates. When you get a quote from State Farm’s website, explain the reason for the claim or call and speak with a representative to get a more accurate estimate.

- Property details: Homes with special features such as a pool or trampoline can cause your home insurance rates to spike since they pose an added liability risk to the insurer.

- Coverage needs: Your home insurance costs are determined in part by your coverage needs. If you have a high home value, you will pay more for dwelling insurance because the cost to repair or rebuild will be more significant following an incident or disaster.

- Deductible: You will have a higher insurance premium if you choose a lower deductible. Raising your deductible to the highest amount available can help ensure lower rates.

State Farm Home Insurance Coverage

Home insurance policies help protect your home and its contents after a covered event. State Farm offers six standard types of home insurance coverage. These include:

| State Farm Home Insurance Coverage |

Description |

|---|---|

| Dwelling | This covers the physical structure of your home and any other structures attached to it. |

| Other structures | Other structures on your property, such as a detached garage, pool house, greenhouse or tool shed, are protected by this option. |

| Personal property | This covers the contents of your home, such as furniture, appliances or clothes. |

| Loss of use/additional living expenses | If your home is damaged by a covered event, this insurance helps pay for a hotel, food and other expenses. |

| Personal liability | If someone is injured on your property, this helps protect you against legal liability for bodily injury or property damage. |

| Medical payments | This pays for injuries incurred to others on your property. |

Additional State Farm Home Insurance Endorsements

Additionally, State Farm also offers:

- Personal liability umbrella policy: This add-on option increases your covered amount for personal liability. Home insurance policies typically provide a minimum of $100,000 in personal liability coverage, but a personal liability umbrella policy could provide coverage for an amount beyond that.

- Flood insurance: This insurance covers losses directly caused by flooding. For example, damage caused by a sewer backup is covered if it resulted from flooding.

- Earthquake insurance: This add-on insurance covers some of the losses and damage that earthquakes can cause to your home, belongings, and other buildings on your property.

Is State Farm Life Insurance Good?

A life insurance policy from State Farm can provide a safety net for your family if you pass away. Standard life insurance policies provide a payout to your beneficiaries when you die, as long as your premium is paid and the policy is active.

State Farm Life Insurance Online

State Farm offers three types of life insurance policies that can be purchased online. These are:

- Term life insurance: This provides death protection for a stated period of time or term. It can be purchased in large amounts for a relatively small premium and is well suited for short-range goals such as coverage to pay off a loan or providing extra protection as your children grow.

- Whole life insurance: This policy can help your family in case the unexpected happens. The guaranteed death benefit helps replace a family’s loss of income, helps with mortgage costs or educational needs. These policies build cash value that grows tax-free.

- Universal life insurance: This provides a flexible way to protect your loved ones and build tax-deferred cash value. It can be structured as a survivorship or joint policy.

State Farm Auto Insurance Reviews: Conclusion

In our State Farm insurance review, we give the company a 9.3 out of 10.0 and name it Editor’s Choice for 2022 based on the criteria mentioned above to rate all car insurance providers.

In this guide, we also explored State Farm’s auto and home insurance coverage, cost and reviews. Below are recommendations for other car insurance companies worth considering when shopping for car insurance.

State Farm Insurance Alternatives

State Farm isn’t your only choice for auto insurance. We recommend getting free auto insurance quotes from providers in your area.

USAA: Low Rates for Military

If you’re in the military or have an immediate family member who is, consider getting a quote from USAA. According to our cost research, this provider offers some of the lowest prices around and a wide range of discounts. Our rate estimates show a full-coverage auto insurance policy with USAA is about 48% cheaper than the national average. It also consistently performs well on industry surveys by J.D. Power and has strong ratings from the BBB and AM Best. We took an in-depth look at this top provider to see how USAA compares with State Farm.

Progressive: Low Rates for High-Risk Drivers

Progressive is known for its affordable rates for drivers who’ve had a recent accident or even a DUI on record. To help drivers save even more, the insurer offers a usage-based program called Snapshot®. If you enroll, your rate will be influenced by your current driving habits rather than just your past driving record. According to our rate estimates, full coverage insurance from Progressive is about 7% cheaper than the national average.

FAQ Car Insurance for Teenagers

Below you will find frequently asked questions about teenage car insurance.

Does State Farm have a good reputation?

QUS: Is State Farm good about paying claims?

ANS: State Farm is generally good about paying out claims. The company received a score of 892 out of 1,000 in the J.D. Power 2021 U.S. Auto Claims Satisfaction Study, which landed it in sixth place.

QUS: Is State Farm overpriced?

ANS: According to our research, State Farm has some of the cheapest rates on average for car insurance. The insurer tends to be about 23% cheaper than the national average in terms of cost.

QUS: What is the rating of State Farm insurance?

ANS: We rate State Farm 9.3 out of 10.0 for its affordable average rates and good customer service record. State Farm also has an A++ financial strength rating from AM Best and a A+ rating from the BBB.

QUS: What is State Farm’s accident claim number?

ANS: Whether you are a State Farm customer or got in an accident with one of State Farm’s insured drivers, you can call 800-732-5246 (800-SF-CLAIM) to file a claim with a local agent. You can also file an insurance claim online or through State Farm’s mobile app.

QUS: Does State Farm cover towing?

ANS: State Farm covers towing with its roadside assistance add-on. State Farm’s collision or comprehensive insurance may cover towing in the event of an accident, as well. If you only have bodily injury and property damage liability insurance, you will have to pay for towing unless the other driver’s insurance covers it.

How much does car insurance drop when you turn 25?

ANS: Young drivers pay the most for car insurance, but average rates decrease with age. Depending on your situation and insurance policy, your rates may decrease by about 10% to 15% when you turn 25.

Overall, State Farm is a reliable and trustworthy insurance company that offers a wide range of insurance products and services to meet the needs of its customers. With its exceptional customer service and competitive rates, State Farm is a top choice for anyone looking for high-quality insurance coverage.