Luxury cars are expensive investments, and they require specialized insurance coverage to protect them on the road. If you own a luxury car, it’s important to find an insurance company that understands the unique needs of high-end vehicles. In this article, we’ll take a closer look at some of the top luxury car insurance companies in the USA.

Coverage Options

Luxury car insurance policies typically offer a range of coverage options to protect your vehicle. These options may include liability coverage, collision coverage, comprehensive coverage, and more. Some policies may also offer coverage for exotic or vintage cars, as well as specialty coverage for items like high-end audio systems.

Discounts

Many luxury car insurance companies offer discounts to help lower your insurance premiums. These discounts may include safe driver discounts, multi-policy discounts, and discounts for security features like anti-theft devices and tracking systems.

Top Luxury Car Insurance Companies in the USA

Here are some of the top luxury car insurance companies in the USA:

- Chubb: Chubb is a leading insurance company that specializes in providing coverage for high-value homes, automobiles, and other assets. Their luxury car insurance policies offer coverage for a range of vehicles, including exotic cars, vintage cars, and high-performance sports cars.

- AIG Private Client Group: AIG Private Client Group offers specialized insurance coverage for high-net-worth individuals, including luxury car owners. Their policies offer a range of coverage options, including liability, collision, and comprehensive coverage, as well as additional coverages like roadside assistance and rental car reimbursement.

- Nationwide Private Client: Nationwide Private Client is a division of Nationwide Insurance that provides coverage for high-value homes, automobiles, and other assets. Their luxury car insurance policies offer coverage for a range of vehicles, including exotic cars, vintage cars, and high-performance sports cars.

- Hagerty: Hagerty is a leading insurance company that specializes in providing coverage for vintage and classic cars. Their luxury car insurance policies offer coverage for a range of vehicles, including classic cars, sports cars, and high-end luxury vehicles.

Why Is Luxury Car Insurance More Expensive?

Luxury cars are typically high-performance vehicles with more amenities than standard vehicles. They tend to have much higher price tags than regular cars. A 2022 Mercedes-Benz C-Class sedan, for example, has a starting manufacturer’s suggested retail price (MSRP) of $43,550. To compare, the starting MSRP for a 2022 Honda Civic is around $23,000 — almost half of what the Mercedes costs.

Like with any vehicle, you’ll need to carry the state-minimum liability coverage to drive a luxury car legally. Because you have a more valuable vehicle, you should expect to pay higher insurance premiums than you would for a regular car.

You’ll likely be able to find coverage from most major providers, but it may be worth getting quotes from companies that specialize in insuring sports cars, convertibles, and other high-value types of vehicles.

How Do I Get Luxury Car Insurance?

The process for getting luxury car insurance is the same as getting coverage for a regular vehicle. You’ll begin by comparing car insurance quotes from a few providers, and then you’ll select the coverage you want.

When getting a quote, you’ll need to provide the following information:

- Vehicle details such as year, make, and model

- Address and contact information

- Your age

- Marital status

- Driving history

- Gender

- Credit history

Once you’ve provided your information, either in an online portal or directly to an insurance agent, you’ll receive a quote. From there, you can select your provider and policy.

Read also: USA High-risk auto insurance

How Much Does Luxury Car Insurance Cost?

Insuring a luxury vehicle is typically more expensive than insuring a standard car. Below is a table that shows the average annual rates for a full-coverage car insurance policy for a few popular luxury cars.

| Make/Model | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| BMW X3 | $2,021 | $2,087 | $2,170 | $2,330 | $2,337 |

| Lexus RX | $2,022 | $2,101 | $2,132 | $2,166 | $2,273 |

| Tesla Model 3 | $2,611 | $2,303 | $2,753 | $2,813 | $3,209 |

| Tesla Model Y* | $2,583 | $2,598 | $2,804 |

*The Tesla Model Y was released in 2020.

The national average for full coverage car insurance is $1,730 per year, and as evidenced in the table, luxury car insurance rates can often be quite a bit more. A 2022 Tesla Model 3, for instance, costs about 85% more than the national average to insure.

Cheapest Luxury Car Insurance

In the sections below, we’ll highlight the cheapest luxury car insurance rates for each of the models we introduced. The annual averages in each table are based on the driving profile of a 35-year-old with good credit and a clean driving record. These averages are for a full-coverage auto insurance policy.

The tables are sorted by the cheapest insurance companies for the 2022 model year. To give you insight into the average insurance cost of previous model years, we’ve also included those rates in the tables.

Based on our research, USAA tends to offer the cheapest insurance rates for luxury cars. Note that USAA policies are only available to current members of the military, veterans, and their families.

BMW X3

Here is a table with the average annual full-coverage rates for five model years of the BMW X3.

| Provider | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| USAA | $1,303 | $1,411 | $1,421 | $1,757 | $1,344 |

| Nationwide | $1,589 | $1,531 | $1,520 | $1,589 | $1,407 |

| Country Financial | $1,321 | $1,384 | $1,438 | $1,519 | $1,597 |

| Auto-Owners Insurance | $1,392 | $1,460 | $1,501 | $1,609 | $1,633 |

| Erie Insurance | $1,756 | $1,632 | $1,802 | $1,917 | $1,788 |

Lexus RX

Below is a table with the average annual costs for insuring five models of the Lexus RX.

| Provider | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Country Financial | $1,388 | $1,419 | $1,385 | $1,430 | $1,450 |

| USAA | $1,347 | $1,435 | $1,333 | $1,437 | $1,454 |

| Erie Insurance | $1,572 | $1,620 | $1,624 | $1,573 | $1,742 |

| Nationwide | $1,530 | $1,522 | $1,799 | $1,419 | $1,760 |

| Geico | $1,584 | $1,625 | $1,637 | $1,686 | $1,761 |

Tesla Model 3

The table below shows the average annual insurance rates for five models of the Tesla Model 3.

| Provider | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| USAA | $1,333 | $1,202 | $1,345 | $1,355 | $1,543 |

| Country Financial | $1,522 | $1,259 | $1,605 | $1,642 | $1,734 |

| Nationwide | $1,737 | $1,516 | $1,902 | $1,881 | $1,835 |

| State Farm | $1,776 | $1,705 | $2,029 | $2,039 | $2,107 |

| Auto-Owners Insurance | $1,850 | $1,480 | $1,971 | $2,053 | $2,155 |

Tesla Model Y

The Tesla Model Y was not available until 2020. This table shows annual rate averages for each available model.

| Provider | 2020 | 2021 | 2022 |

|---|---|---|---|

| Country Financial | $1,398 | $1,453 | $1,508 |

| USAA | $1,544 | $1,514 | $1,573 |

| Nationwide | $1,632 | $1,515 | $1,580 |

| Auto-Owners Insurance | $1,769 | $1,751 | $1,969 |

| NJM Insurance | $1,833 | $1,870 | $1,987 |

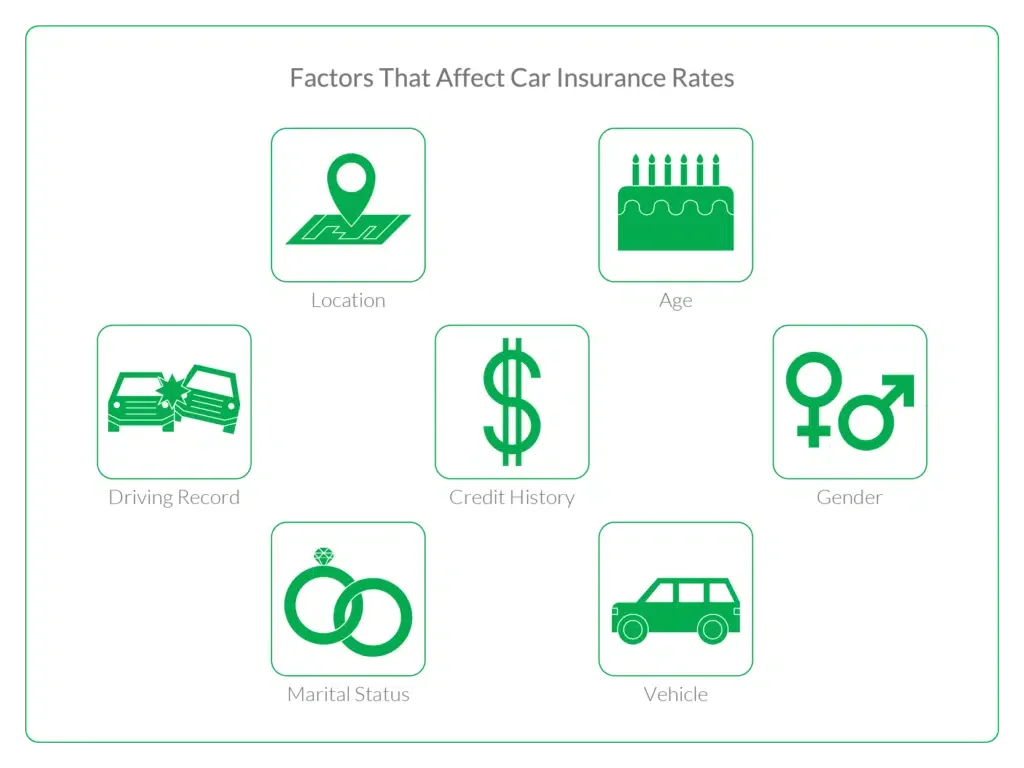

Factors That Affect Car Insurance Rates

When calculating auto insurance quotes, agents weigh a number of factors. Because these factors are highly variable, your car insurance quote is almost guaranteed to be different from anyone else’s.

These are the factors that determine your car insurance rates:

- Location: If you live in an area with high rates of theft or car accidents, you may pay more for insurance coverage.

- Age: Younger drivers and drivers over 65 are considered higher risk by insurers, so they pay more for car insurance.

- Driving record: If you have any traffic violations, at-fault accidents or DUI convictions on your record, you can expect to pay higher insurance rates.

- Credit history: Drivers with good credit scores tend to pay less for coverage than those with poor credit.

- Gender: Male drivers are more likely to get into car accidents, so they tend to pay more for auto insurance.

- Marital status: Single drivers typically pay more for insurance than married drivers.

- Vehicle: More expensive vehicles cost more to insure.

In many cases, you’ll be able to choose the deductible on your insurance policy. If you opt for a higher deductible, you’ll have a lower premium and vice versa.

Collision and Comprehensive Coverage

A full-coverage policy generally includes collision and comprehensive coverage, but it’s worth making sure. Experts recommend drivers carry both types of insurance if the premium is less than 10% of a vehicle’s value. Collision insurance covers repair costs after an accident no matter who’s at fault. Comprehensive insurance covers the cost of damages from non-collision events like fire, theft or falling objects.

Gap Insurance

If you’re leasing or financing your luxury car, gap insurance (also known as loan/lease payoff) may be worth adding to your insurance policy. If your car is totaled or stolen and you owe more than the car is worth, gap insurance can help cover the difference. When you file a total-loss claim, the insurance company will pay out the actual cash value (ACV) of your vehicle. If the ACV is less than the remainder of your auto loan, gap insurance kicks in to pay it off.

Classic Car Insurance

Some insurers offer specific coverage to protect classic vehicles and exotic cars. Classic car insurance, sometimes called antique auto insurance or collector car insurance, has different requirements than standard auto insurance. These often include strict mileage limitations and a professional appraisal of the vehicle.

Uninsured/Underinsured Motorist Coverage

Depending on where you live, you may already have underinsured/uninsured motorist coverage included in your policy. This coverage helps pay for damages caused by a driver who doesn’t have auto insurance or has policy limits that are too low. Because luxury cars cost more to repair, you’ll want to make sure the vehicle is fully protected to avoid paying for damages out of pocket.

Luxury Car Insurance Rates: Conclusion

Luxury car insurance rates are typically higher than those for regular vehicles. Luxury car insurance is essentially the same as standard car insurance since you’ll need to carry whatever the state requires to legally drive. If you have an antique or exotic vehicle, you may want to look into classic car insurance.

Top Auto Insurance Recommendations

When you’re looking into luxury car insurance, it’s important to compare more than one provider. That way, you can get the best possible rate for your vehicle and situation. Below are two car insurance companies we recommend.

Geico: Affordable for Most Drivers

Geico offers some of the country’s lowest car insurance rates on average. In our industry-wide review of the top insurance providers, we found that Geico’s average rates are around 24% cheaper than the national average. In addition to its wide range of coverage options, Geico offers many discounts. Drivers who have safety features in their vehicles, practice safe driving habits or have new cars can all save money on their premiums.

Travelers: Most Coverage Options

Like most major car insurance companies, Travelers offers standard options like collision coverage, personal injury protection, and liability insurance. The company also provides a large array of optional coverages, including accident forgiveness, gap insurance, and two levels of roadside assistance. Policyholders can save money by bundling their auto coverage with another insurance product, such as homeowners or life insurance.

Conclusion

Owning a luxury car requires specialized insurance coverage to protect your investment on the road. By working with a reputable insurance company that understands the unique needs of high-end vehicles, you can ensure that your luxury car is properly protected. Be sure to compare coverage options and discounts from different insurance companies to find the policy that best fits your needs and budget.

FAQ Luxury Car Insurance Rates

Is it more expensive to insure a luxury car?

What car brands are considered a luxury for insurance?

Higher-end car brands like Mercedes-Benz, BMW, Audi, Porsche, Maserati, Lexus, Tesla and Lamborghini are all considered luxury brands. Because they have higher repair costs, they’re usually more expensive to insure than other brands.

Is BMW expensive to insure?

Based on data from Quadrant Information Services, some providers’ average rates for full coverage on a 2022 BMW X3 can range from $779 to $7,144 per year. On average, the 2022 BMW X3 costs $2,337 per year to insure. That’s about 35% higher than the national average for full-coverage insurance, which is $1,730 per year.

Thank you for this piece